Today is the last day of Financial Literacy Month. To tie everything together, I thought it would be fun to share an interview my real millionaire next door, a man we’ll call John. He used the basic tenets of money management to build wealth and to retire early. Here’s how I described John when I first wrote about him last year:

John is a 71-year-old retired shop teacher who lives in a modest ranch house on half an acre, the same house he's had for over forty years. He has an old barn filled with salvaged lumber, outdated appliances, and who knows what else. When he's around, he drives a junkie 25-year-old station wagon. But most of the time, he's not around.

He spends his winters in New Zealand helping friends on a dairy farm. His summers are spent fishing in Alaska. For a couple of months each year, he's home, puttering in the yard. Year-round, he rents his house to boarders. He leads a very active retirement.

John’s story was popular with Get Rich Slowly readers, and many of you asked me to interview him. I had to wait for him to return from New Zealand, but earlier this month, the opportunity finally presented itself. John agreed to sit down for a chat.

“I want to take you to lunch at the Chinese place up the street,” I told him.

“What the hell for?” he asked.

“Just to be nice,” I said. “To thank you for taking the time to speak with me.”

“I don’t need that,” he said. “Save your money. Let’s just sit at your dinner table.” And so we did.

In the beginning

Before John left for New Zealand just after Christmas, I mentioned the idea of an interview. He liked the notion, so on his flight home at the end of March, he made some notes about his financial philosophy. “These are my secrets to financial freedom,” he told me, showing me what he had jotted on the back of an envelope. “This is what I did to get where I am today.”

“I’m ready,” I said. I had a yellow legal pad and a Bic pen. I motioned for him to continue.

“It was interesting to do this,” John said. “It’s really the story of your web site. The real secret is to spend less than you earn. I don’t care how much you earn, you spend less than you earn.”

I laughed. “My readers aren’t going to like that,” I said. “There’s a vocal group that complains that personal finance writers are always preaching ’spend less than you earn’.”

“It’s not funny,” John said. “Because that’s the secret. They don’t have to like it, they just have to do it.”

“Right,” I said. “There are no magic bullets. There are no special shortcuts. Now, before we get started, can you tell us a little bit about your background?”

“Well, I’m retired,” John said. “I’m 72 years old. I spent twenty years as a shop teacher at a junior high school. I retired at 58. Before that, I did other things. I worked as a carpenter for eight years, and I spent six or seven years working in the juvenile court system.”

“Did you have good financial habits growing up?” I asked.

“Yeah, I really did. My family had a lot of money. We owned a big hardware store. But I saw money wasn’t the key to happiness. There were other families that were happier that had far less. But I’m grateful for having grown up with a solid financial background.”

On frugality

“What advice do you have for people who want to spend less?” I asked.

“Well, I made this list,” John said, pointing to his old envelope. “I listed all of the things I do. First of all, people should learn what a kilowatt hour is. A kilowatt hour is a thousand watts burned for an hour. All of these appliances left on standby draw power. And don’t leave your lights on.” John gave me a look.

I was sheepish. The lights were on in the bathroom and the kitchen, but we were sitting in the dining room. I got up to turn them off while he continued speaking.

“Learn to figure your own power bill and know why it is what it is. People should learn about electrical use. That’s a drain on your monthly budget. Every penny saved on electricity is a penny you can use for something else.”

“No smoking or alcohol consumption,” he continued. “This has nothing to do with morals and health — okay, maybe health — it’s all about the money. I see people with a cigarette in their mouth, and I think, ‘That’s 25 cents!’” I laughed.

“Don’t have a credit card without autopay. And if you have a credit card, you should benefit from it. I use a credit card for everything I can, but I get things back from that.”

“Like air miles?” I asked.

“Exactly,” John said. “Air miles or a cash rebate. And I have my bank automatically pay the bill every month.”

“Next is food,” he said. “I think people’s eating habits are hell-bent on spending money.”

“Yeah,” I said. “I offered to take you to lunch while we talked.”

“I know, but I don’t need that gesture. I appreciate it, but that’s money that could be spent on other things. Like your new car!”

“You don’t have to spend a lot on food,” John continued. “When I go to the grocery store — which is rarely — I don’t know how anyone could afford to feed a family on that stuff. It seems outrageously expensive. People need to learn to cook from raw ingredients.”

“But where do you get the raw ingredients?” I asked.

“From the farmers market! Or Costco! You don’t need the little individual servings. That’s crazy. You have to be creative. Part of the problem is that you need to buy a freezer. Or look,” he said, waving his hand at Kris’ seedlings. “Over there are your tomato starts. Those cost you what? 50 cents? You’ll get 50 dollars of fruit from those! Plus I buy what I can in bulk.”

“Eating in-season food is important. It’s less expensive and it’s better quality. I also like this eating close to home thing. That’s neat.”

“Kris makes her own granola,” I offered.

“Yeah,” he said. “Exactly. But nobody advertises that. Nobody advertises ‘make your own granola’. Again, it makes sense to own a freezer. The electrical use of a freezer is pretty tiny. That’d be an interesting article for you, J.D. How much electricity does a freezer use versus how much you save by buying in bulk? People don’t understand about electrical use. They have a foggy notion about it.”

“Yeah, I have this device called a Kill-a-Watt,” I said. “It measures electricity use. But I’ve never checked our freezer.”

“Here’s another thing,” John said. “It’s okay to buy used. There’s nobody advertising to be thrifty. There’s nobody advertising to go to Goodwill. That’s not where the profit is. People have to get permission to buy used from somewhere else, because they’re not going to get it from advertising. I buy all sorts of stuff used, but especially cars. I bought my minivan off Craigslist.”

“How did that work?” I asked.

“It worked great,” John said.

“I bought my Mini Cooper used,” I said, “but I didn’t do it as well as I could have. I didn’t take it to a mechanic, for example.”

“I took my car to two mechanics. I wanted to be sure.”

He rattled off a few more tips. “Do your own home repairs. Use the library more — movies and books, and it’s totally free. I think that’s great. Remember: A dollar spent will never produce dividends. Money spent is gone and will never earn you anything.”

On investing

“That’s a good transition,” I said. “Let’s talk about your approach to investing.”

“I advise people to look for good investments. Take some time to do research. And think outside the box. I just re-opened my account with Reliable Credit. They offer 4%, which keeps up with inflation.” Reliable Credit is a nearby consumer finance company. But it’s not a bank. They take deposits from people like John and they loan them to high-risk clients. They do a lot of used car loans.

“The thing that worries me about Reliable Credit is that they’re not insured. There’s no FDIC insurance,” I said.

“Doesn’t bother me,” John said. “I’m not putting a whole lot in there. It’s just part of my money.”

“What would happen if you lost it all?”

“Not a big deal. I own my home. I have a guaranteed pension. I have no debt. That’s the key. Because I’ve done these other things, I can afford to take some risk. A lot of people can’t.”

“What about your other investments?” I asked.

“If you’re going to do stocks, diversify your stock holdings,” John said. “But for me, no-load mutual funds are the only way to go. To give anybody 3-4% of your money off the top is insane. It used to be I wasn’t aware how much I was paying. Once I figured it out, I thought, ‘Shit, I can make these mistakes myself. Why should I pay anybody to do it for me?’”

“I invested in small-cap funds at Columbia here in Portland. What a great move that was. Those did very well. I tracked their growth in the newspaper. Every week I drew a graph. I plotted the weekly high and the low and where it closed. I had to keep making new pages for my records because it was growing so much. I didn’t mind,” he said, laughing. “Back in the olden days, if I wasn’t getting 20% a year, I looked someplace else. But I can’t hold that up as an example — although it may happen again if things get turned around, once this economy corrects itself.”

“Does this economy worry you?” I asked.

“No. I don’t have to worry about it. I don’t need the income. I’m debt-free. If I was retired and had a mortgage or other debt, or if I had health problems, it would worry me. To my mind, even if you invest and it goes to hell, it’s still better than nothing. The odds of that are pretty slim, though, especially if you diversify.”

“What are your financial goals?” I asked.

“I used to say that when I reached $100,000 I would have arrived. But I got there so fast, I just kept going. Some people plan for retirement, but I didn’t plan. I did go to investment workshops — free workshops — that were put on for the teachers, and I learned from them. You’d be surprised at how few people showed up to them. Nobody cared.”

“When did you start to save?” I asked.

“It must have been 30 or 35 years ago,” John said. “And I’m glad I did. I think there are people who still don’t take advantage of tax-advantaged savings and investments accounts. I did this as soon as I could. I was amazed at how many teachers didn’t take advantage of this. That’s crazy.”

On choosing a lifestyle

John looked back down at his list. “Here’s another thing,” he said. “Volunteer to help others. I really think that’s an important personal lifestyle choice. It feels good to me. I used to do scouting. I had a Boy Scout troop for fifteen years.”

“You know, scouting was important for me when I was a boy,” I said. “I think it can be a great experience.”

“Sure it can,” John said. “When I was growing up, a lot of people shared things with me. It feels good to be in a place to be able to share myself now.”

“What kind of things do you share?”

“Well you know I rent the house, but it’s basically at cost. I don’t charge much at all. I host guests on my boat [in Alaska] at no charge. I do my work in New Zealand. Earlier today I picked up some sheet metal. I went and bought some scrap sheet metal and I took it in to Franklin High School. I took it to their metal shop. They can really make use of that.”

“What do you splurge on?” I asked. I’ve seen the things John owns. They’re very functional. He doesn’t have a lot that I would consider “fun”.

“Some people would say that buying a boat is a splurge,” he said. “But I bought that boat right. I bought it for less than market value. I’ve taken care of it. I’ll get a lot more use out of it.”

“I guess I could eliminate a couple thousand dollars airfare getting to New Zealand and back, but I spend very little money when I get there. If I spend a couple hundred dollars in New Zealand, I’d be surprised.”

“How do you keep your costs so low there?”

“I work on farms. I’m part of Willing Workers on Organic Farms. You travel to someplace and do work on their farms for them. They provide room and board. Sometimes they take you to do local stuff. This year I got to see sheepdog trials. That was fun. Anyhow, I do carpentry work. I build stuff and fix things. There are four farms I go to, about three weeks at a time, and I do what needs done.”

He paused for a moment and smiled. “But Alaska is just for fun.”

“How long have you been doing this now?”

“I’ve been doing this for about fifteen years, ever since I was retired. Back when I was 58.”

Reader questions

We’d come to the end of John’s list, but we weren’t finished yet. “I told some of my readers that I was going to interview you,” I said. “They sent in some questions. Would you be willing to answer them?”

“Sure. Of course.”

“Annie Blue wants to know how money affects your daily happiness.”

“Well,” he said. “I can buy whatever I want. Not need, but want. I just don’t want very much. I always have $100 in my pocket, but I don’t piss it away. I don’t stop for coffee. I seldom eat out.”

“I understand why people buy things,” he said, “I like to buy things, too. There’s a certain satisfaction in looking at the things you’ve accumulated. It’s like an affirmation that you’re doing things right. So you surround yourself with things that make you think you’re doing well — but they’re not necessary. That’s one of the advantages of being older. People just leave you alone to do what you want.”

“Next,” I said, “Suburban Dollar wants to know what advice you’d give to a 30-year-old.”

“Spend less than you earn. This is true whether you’re on welfare or a millionaire. And remember: wealth is created by investing money, not by working longer and harder.”

“Here’s another thing,” he said. “Remember that when you’re raising kids and stuff, that’s really hard. The demands on your money are so great. But you’ve got to be willing to say no. So much money is pissed away to keep kids happy.” (John has grown children. He’s speaking from experience.)

“Here’s a final question from Bill in Detroit,” I said. “He wants to know if outer wealth causes inner wealth. Or is it the other way around? Or are they completely disconnected?”

“There’s a lot of personal power from personal spending,” John said. “If I’m feeling down in the dumps, going out and buying something gives me a lift. But I’m aware of that. I’m aware of how it makes me feel and it helps me to not do it.”

“I think it all has to do with how you feel about yourself,” John said. “I learned long ago that it was okay to spend less than I earned. It wasn’t going to kill me. And I learned that by doing so, I felt really good about myself. I still do. I’m happy. I feel really comfortable.”

I thanked John for answering my questions, and we walked out to look at the vegetable garden. He admired our onions and peas and asparagus. We discussed whether it was time to rototill. At last, we shook hands and said our farewells. I was headed to California in the morning, and he was off to Alaska. He’ll be there until about the time his grapes are ready to harvest in September. I’ll miss him while he’s gone. But if I’m lucky, I just might get to spend a week with him on his boat this summer, catching a glimpse of what early retirement is like.

—

Related Articles at Get Rich Slowly:

Read more about The Secrets of Financial Freedom: An Interview with the Millionaire Next Door…

Cash advances are being relied upon by consumers as they try to make it through their monthly bills. A cash advance can pay for overwhelming debt or an emergency bill because it is quick and easy. Most lending companies for these types of loans make the application process as simple as possible. If you are employed, are over 18 and have an active bank account, you can apply for the loan. The lender will look into approval and calculate ho w much you are eligible to receive. If a company ultimately approves you, your funds are deposited into your account within 48 hours, sometimes sooner.

Cash advances are being relied upon by consumers as they try to make it through their monthly bills. A cash advance can pay for overwhelming debt or an emergency bill because it is quick and easy. Most lending companies for these types of loans make the application process as simple as possible. If you are employed, are over 18 and have an active bank account, you can apply for the loan. The lender will look into approval and calculate ho w much you are eligible to receive. If a company ultimately approves you, your funds are deposited into your account within 48 hours, sometimes sooner.

After playing a few rounds of the

After playing a few rounds of the  America’s big automakers have all been in serious need of

America’s big automakers have all been in serious need of  Welcome back. You’ve made it to the very end of “Repair Your

Welcome back. You’ve made it to the very end of “Repair Your

A major shift in political power has occurred on Tuesday, April 28. Conservatives in the Republican party look upon the shift with scorn, but Democrats are welcoming the change with open arms. They should - their ability to slam legislation through the Senate could be within reach. Good things for liberals, not so good for those

A major shift in political power has occurred on Tuesday, April 28. Conservatives in the Republican party look upon the shift with scorn, but Democrats are welcoming the change with open arms. They should - their ability to slam legislation through the Senate could be within reach. Good things for liberals, not so good for those Welcome back to “Repair Your

Welcome back to “Repair Your

Good hygiene habits are always important, even more so when you are around others with contagious illnesses. Whether you are at home, school, work or out in public, the opportunities to contract a communicable disease are many. This is particularly true with the recent outbreak of swine flu the CDC (Center For Disease Control at cdc.gov) has taken action against. It has been classified as a public health emergency, so wash your hands regularly and, if you know you’re going to be around people you have been exposed, make sure they’re wearing a face mask. It’s common courtesy and it’s safe.

Good hygiene habits are always important, even more so when you are around others with contagious illnesses. Whether you are at home, school, work or out in public, the opportunities to contract a communicable disease are many. This is particularly true with the recent outbreak of swine flu the CDC (Center For Disease Control at cdc.gov) has taken action against. It has been classified as a public health emergency, so wash your hands regularly and, if you know you’re going to be around people you have been exposed, make sure they’re wearing a face mask. It’s common courtesy and it’s safe.

You can sometimes obtain a forbearance with reduced payments, an extended repayment time, or a temporary cessation of payments until your career and financial circumstances improve. If you have several student loans, you can consolidate them into one loan and spread the payments over a longer period of time at a lower interest rate. In some circumstances, you may even be entitled to forgiveness of a portion of your debt. ... click here to read the rest of the article titled "

You can sometimes obtain a forbearance with reduced payments, an extended repayment time, or a temporary cessation of payments until your career and financial circumstances improve. If you have several student loans, you can consolidate them into one loan and spread the payments over a longer period of time at a lower interest rate. In some circumstances, you may even be entitled to forgiveness of a portion of your debt. ... click here to read the rest of the article titled " The Internet is all abuzz with news of Susan Boyle’s makeover. After the initial eyerolling and laughter when she first walked on the “Britain’s Got Talent” stage, Susan Boyle endeared herself to viewers the world over with her amazing voice.

The Internet is all abuzz with news of Susan Boyle’s makeover. After the initial eyerolling and laughter when she first walked on the “Britain’s Got Talent” stage, Susan Boyle endeared herself to viewers the world over with her amazing voice.

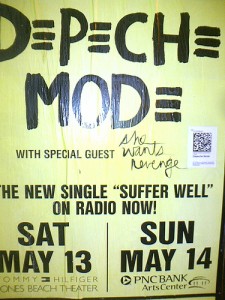

Saving money on entertainment usually means watching unknown bands in dive bars — but not tonight. World class band Depeche Mode will play a free concert on Hollywood Boulevard tonight to promote their new album “Sounds of the Universe.”

Saving money on entertainment usually means watching unknown bands in dive bars — but not tonight. World class band Depeche Mode will play a free concert on Hollywood Boulevard tonight to promote their new album “Sounds of the Universe.” These are tough financial times

These are tough financial times Ask an attorney

Ask an attorney As General Motors faces the possibility of bankruptcy, the company says there may be a nine-week GM shutdown starting as soon as next month.

As General Motors faces the possibility of bankruptcy, the company says there may be a nine-week GM shutdown starting as soon as next month. Your budget is a microcosm of your life. I know that’s a scary prospect for many people, considering how often they may use

Your budget is a microcosm of your life. I know that’s a scary prospect for many people, considering how often they may use